-

Loan EMI

1000 -

Total Interest Payable

1000 -

Total of Payments

(Principal + Interest)

1000

About EMI

EMI is a fixed payment amount paid by a borrower to a lender( e.g bank) at a specified date in each calendar month.

EMIs are used to pay off both interest and principal each month so that over a specified number of years, the loan is paid off in full.

The interest component of the EMI would be larger during the initial months and gradually reduce with each payment.

The exact percentage allocated towards payment of the principal depends on the interest rate.

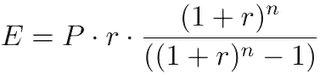

Formula to calculate EMI:

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

For example, if you borrow ₹10,00,000 from the bank at 10.5% annual interest for a period of 10 years (i.e., 120 months),

then EMI = ₹10,00,000 * 0.00875 * (1 + 0.00875)120 / ((1 + 0.00875)120 – 1) = ₹13,493. i.e., you will have to pay ₹13,493 for 120 months to repay the entire loan amount.

The total amount payable will be ₹13,493 * 120 = ₹16,19,220 that includes ₹6,19,220 as interest toward the loan.

Computing EMI for different combinations of principal loan amount, interest rates and loan term using the above EMI formula by hand is time consuming and complex.

But this EMI calculator automatically do this calculation and gives you the result instantly along with visual charts displaying break-up of total payment.

Download from Play Store

Download from Play Store